We may earn money or products from the companies mentioned in this post.

Some affiliate links were used in this post, which means in some cases I will be compensated if you apply for the cards in this post. All my thoughts and opinions on these card are honest and true. These are cards that I use a personally on on a regular basis.

Many view credit cards as evil and in some cases I would agree. I don’t believe in carrying credit card debt, but I do believe in making the credit cards work for me. We use credit cards to pay for pretty much everything at our house and we pay them off each and every month in full. (in fact the total monthly charge comes out of our checking account each month to ensure they are paid in full). I am sharing the rewards cards I use on a regular basis and the rewards we are getting from them. We have been able to do a bunch of traveling previously and especially this year thanks to the perks from these cards.

While some believe that when you use a credit card you may end up buying more than you need, I don’t necessarily think that is true for everyone. I’m a person that gives serious thought to even my 90% off Target holiday purchases. I am probably an over thinker, but in the long run I don’t think that is a bad thing. So, while credit cards my not be for everyone, they work really well for our family and we are happily enjoying the rewards. I encourage you to decide if some of these options would be good for your family too. If you currently carry credit card debt, I personally would not recommend adding another card to your wallet.

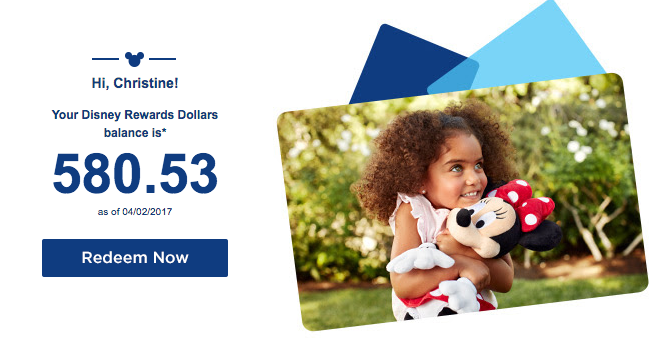

Disney Visa – This is the coolest credit card for Disney nerds, you can even choose your favorite Disney image for the front of the card. I currently have Darth Vader and I get comments nearly every time I shop. I was offered $200 statement credit when I signed up for the card. There is no fee for the standard card and you will earn the $50 statement credit, if you sign up for the premier card you will earn $200 statement credit if you purchase $500 in the first 3 months. It’s a super easy way to earn $200 to put towards a Disney vacation.

- 1% in reward dollars on all purchases (2% reward dollars with the premier card at gas stations, grocery stores, restaurants and most Disney locations – $49 fee for premier card)

- $10 off $50 purchases at select locations at the Disneyland® and Walt Disney World® Resorts

- Disney Character Experience at private Cardmember location at the Disneyland®and Walt Disney World® Resorts. You’ll receive downloads of your photos, too!

Target REDcard – I use the card for any purchases I make at Target both online and in-store. The fact that you get an additional 5% off everything and FREE shipping at Target.com is a huge plus for me. If you have no interest in getting a credit card, they also offer a debit version of Target REDcard.

Amazon Prime Rewards Visa – Amazon also offers a similar discount to the Target REDcard for those of you that are Prime members. If you are a Prime member (I am) you can earn 5% back on all your Amazon.com purchases with the Amazon Prime Rewards Visa. I can’t say no to a 5% discount, especially when I shop Amazon.com regularly. You can now also get 5% back at Whole Foods Market with the Amazon Prime Rewards Visa. I was offered a $75 Amazon gift card at the time I opened the account. You will earn 2% cash back at all restaurants, gas stations and drug stores and 1% back everywhere else. This card does not have an annual fee.

Alaska Airlines Visa – This is the airline that we fly most of the time, so it made sense for us to go with the Alaska Airlines card for travel benefits. I primarily signed up for this card for the 30,000 miles and the companion airfare (my husband has this card too, so we already get the benefit of the free checked bags). I only really use this card for Alaska Airline purchases now. To give you an idea of what the 30,000 miles can you get you. We used 30,000 miles to fly one person to Maui Hawaii. We’ve also used 30,000 miles to fly 4 people from Seattle to LAX (they had a sale of 7500 miles per person). Here are the perks of the card (love the companion airfare and free checked bags):

- 30,000 bonus miles after you make $1,000 or more in purchases within the first 90 days.

- Free checked bag for you and up to six other passengers on your reservation

- Annual companion fare from $121 (USD) ($99 base fare plus taxes and fees from $22) after you make $1,000 or more in purchases within the first 90 days of your account opening.

- Earn 3 miles for every $1 spent on Alaska Airlines tickets, vacation packages, cargo, and inflight purchases & 1 mile for every $1 spent on all other purchases.

They currently have a limited time offer where you can buy one ticket and get one for just the taxes ($22).

Hyatt Visa – This Hyatt credit card is the most recent card I signed up for and it was again for the sign up bonus. When I signed up they were offering 2 free nights at any Hyatt hotel or resort worldwide after you make $2,000 on purchases in the first 3 months after account opening (this offer is no longer valid). They also offer a free night at a category 1-4 hotel each year after you anniversary date. We had plans to visit Paris this summer so I signed up for this card in order to get 2 free nights at the Park Hyatt Paris-Vendôme. This hotels is a 5-star hotel that retails for roughly $700 a night. Thanks to the card we got 2 nights free. (My husband also signed up for the card so we got 2 free nights at a different hotel in Paris too). This card does have an annual fee of $75, but in my opinion you pretty much get that covered with the free hotel stay each year.

Kohl’s Store Card – Kohl’s rewards their card members with discounts. Since Kohl’s is the main department store where I live, we do a lot of our clothes shopping here. The additional perks make the card worth it to me. I get a coupon during my birthday month and I often have access to the 30% off coupons that are only available to Kohl’s cardholders. They also offer free shipping codes for Kohl’s cardholders too.

Do you have a credit card that you use for rewards? I love to hear which ones are our favorite.

Wondering which credit card you used while in Europe? Did you have to pay a foreign transaction fee?

Wendy,

We used our Hyatt Visa card while we were in France. There were no foreign transaction fees with this card. The Hyatt card is from Chase and I think most of their cards don’t have a foreign transaction fee. That is one thing you definitely want to check on before traveling internationally.

AmEx Blue Cash Preferred – 6% cash back on groceries, 3% back on gas, 1% everything else, bc there’s a $95 annual fee you’ll have to do the math whether preferred is a better option over the standard one which offers lower reward percentages without the annual fee. Great customer service and purchase protection.

Chase Freedom – 5% back on quarterly bonus categories, which includes restaurants at least one quarter per year. No annual fee.